ETH Price Prediction: Bullish Targets for 2025–2040

#ETH

- Technical Breakout: ETH's MACD convergence and upper Bollinger Band test signal bullish momentum.

- Institutional Demand: $10B reserves and $1.8B ETF inflows underscore institutional confidence.

- Price Targets: $13K by 2025, $100K+ by 2040 amid scalability and tokenization trends.

ETH Price Prediction

ETH Technical Analysis: Bullish Signals Emerge

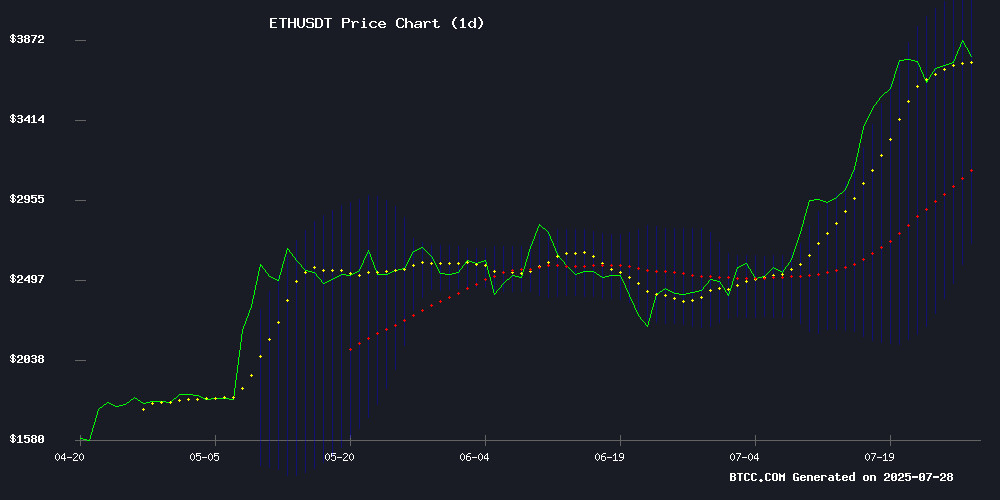

Ethereum (ETH) is currently trading at $3,769.21, showing strong momentum above its 20-day moving average (MA) of $3,422. The MACD indicator remains negative but is converging, suggesting potential upward momentum. Bollinger Bands indicate volatility with the price NEAR the upper band at $4,138.39, signaling bullish pressure. BTCC analyst Mia notes, 'ETH's technical setup favors further upside, with a break above $4,000 likely to accelerate gains.'

Market Sentiment: Ethereum Eyes $4,000 Amid Institutional Demand

Ethereum's price consolidation near $4,000 reflects cooling volatility but strong institutional interest, with reserves nearing $10B. News of BTCS Inc. expanding ETH holdings and ETF inflows exceeding $1.8B underscores growing confidence. Analyst Mia highlights, 'The $4,000 resistance is a key psychological level—breaching it could trigger a rally toward $13K by Q4, as institutional accumulation intensifies.'

Factors Influencing ETH’s Price

Ethereum’s Volatility Cools as $4,000 Resistance Holds Firm

Ethereum's price action stalled after a decisive rejection at the $4,000 psychological barrier, with on-chain metrics signaling weakening momentum. The second-largest cryptocurrency by market cap saw volatility drop to 47.6% from recent highs of 53.9%, while whale transaction volume plummeted from $21.3 billion to $5.9 billion within seven days.

Liquidations totaled $124.5 million in the past 24 hours as both longs and shorts got squeezed. The cooling activity comes despite Ethereum spot ETFs recording $452 million in inflows on July 25, suggesting institutional interest remains strong even as retail traders take profits.

BTCS Inc. Surges on $10M Premium Financing and Ethereum Reserve Expansion

BTCS Inc. (Nasdaq: BTCS) shares climbed 5.42% to $5.36 following the close of a $10 million convertible note offering priced at a 198% premium. The blockchain infrastructure firm simultaneously expanded its Ethereum holdings by 14,240 ETH, bringing total reserves to 70,028 ETH valued at approximately $270 million.

The premium pricing of $13 per share—nearly triple the stock's July 18 closing price—reflects institutional confidence in BTCS's hybrid DeFi/TradFi strategy. This capital injection fuels what the company describes as an "accretion flywheel," strategically growing assets while minimizing shareholder dilution.

Market reaction underscores growing appetite for structured crypto investment vehicles. At current ETH prices near $3,850, BTCS's expanded position makes it one of the largest publicly traded Ethereum holders.

NFT Market Struggles Amid Crypto Winter Despite Isolated High-Value Sales

The NFT market, once a symbol of Web3's punk rock ethos, continues to languish in a prolonged bear cycle. Trading volumes for NFT art have plummeted 93% since their 2021 peak, with July 2025 figures reaching just $156 million—a far cry from OpenSea's $3 billion monthly volumes during the August 2021 frenzy.

Isolated bright spots emerge as collectors deploy capital like performance art: 45 CryptoPunks changed hands for $8 million, while an Ether Rock fetched over $300,000. Pudgy Penguins and Moonbirds saw floor prices double and triple respectively, suggesting niche liquidity persists among blue-chip collections.

The market's struggle reflects broader crypto winter pressures, where even true believers face eroded conviction. Yet these transactions echo the original 'if it went to zero' mentality—where cultural signaling often trumped financial logic during NFTs' speculative heyday.

Ethereum at 10: Scaling Beyond the Trilemma

As Ethereum marks its 10th anniversary, the blockchain has matured from a developer sandbox to the foundation of onchain finance. Institutions like BlackRock and Franklin Templeton are now launching tokenized funds, while banks deploy stablecoins—testing Ethereum's capacity to handle global demand where speed and throughput are critical.

The long-standing 'blockchain trilemma'—the perceived tradeoff between decentralization, scalability, and security—remains a focal point. Yet this framework, introduced by Vitalik Buterin, is increasingly viewed as a solvable design challenge rather than an immutable constraint. Ethereum's evolution suggests that decentralized systems can overcome performance bottlenecks, much like the electric grid and internet before it.

Strategic Ethereum Reserve Nears $10B as Institutional Demand Surges

Ethereum's institutional adoption reaches a pivotal moment as Strategic ETH Reserves (SER) now hold 2.32 million ETH ($9.02 billion), representing 1.92% of circulating supply. The reserve, distributed among 64 participants, has grown exponentially since April, with accumulation accelerating sharply in late July.

ETF holdings tell a parallel story—5.80 million ETH ($22.58 billion) now sit in these vehicles, accounting for 4.81% of supply. The 16-day inflow streak, averaging 122,000 ETH daily, underscores mounting institutional conviction. SharpLink Gaming emerges as a key player, staking 77,210 ETH ($295 million) in its latest move, bringing total holdings to 438,017 ETH ($1.69 billion).

Market observers note the staking strategy allows institutions like SharpLink to compound gains through yield generation. This dual approach—direct reserve accumulation plus ETF inflows—signals Ethereum's maturation as an institutional-grade asset.

Ether Poised for Major Rally: Analyst Predicts $13K Target by Q4 Amid Institutional Accumulation

Pseudonymous crypto analyst "Wolf" projects ether could surge to $13,000 as early as Q4 2023, with a conservative estimate of $8,000—more than double current levels. The forecast follows ETH's breakout to new all-time highs, though Wolf anticipates a 20-25% corrective pullback before resuming its upward trajectory.

Institutional demand appears to validate the bullish thesis. SharpLink Gaming (SBET) has aggressively expanded its ETH holdings, purchasing an additional 77,210 ETH ($295M) this week. The Nasdaq-listed firm now controls 438,017 ETH ($1.69B)—the largest corporate ether treasury—while generating staking rewards of 567 ETH since June.

The accumulation coincides with strategic hires including former BlackRock executive Joseph Chalom as co-CEO. Placeholder Ventures' Chris Burniske notes shifting sentiment, suggesting growing recognition of ETH's value proposition among traditional finance players.

BTCS Expands Ethereum Reserves to $270M Following $10M Capital Raise

BTCS Inc. (Nasdaq: BTCS) has bolstered its cryptocurrency holdings with a strategic acquisition of 14,240 ETH, bringing its total Ethereum reserves to 70,028 tokens. At current market prices, the stash is valued at approximately $270 million.

The blockchain technology firm simultaneously closed a $10 million convertible note offering at a 198% premium to its July 18 share price. "This financing accelerates our DeFi/TradFi Accretion Flywheel strategy," the company stated, highlighting the $13 per share conversion price as a vote of confidence from investors.

CEO Charles Allen emphasized the revenue-generating potential of the expanded ETH position, noting yield from NodeOps staking and Builder+ block building operations. The move comes as institutional crypto holdings gain prominence on corporate balance sheets.

HashKey Capital Moves $47M in Ethereum to OKX, Sparking Sell-Off Concerns

Ethereum's rally shows signs of fatigue as prices retreat from the $3,900 level. The cooling momentum coincides with a 12,000 ETH transfer—worth $47.18 million—from a wallet linked to HashKey Capital to OKX exchange. Large exchange deposits often precede institutional selling.

Market participants brace for potential volatility ahead of the Federal Reserve's rate decision. While Ethereum's breakout earlier this month appeared technically strong, analysts note weakening follow-through. "The breakout lacked conviction," observes crypto strategist Michaël van de Poppe, suggesting vulnerability to a pullback.

The timing of HashKey's transfer raises questions about profit-taking among sophisticated investors. Exchange inflows at key resistance levels frequently precede short-term corrections, particularly when macroeconomic catalysts loom.

BTCS Inc. Expands Ethereum Holdings to $270 Million Amid Strategic Growth

BTCS Inc. (Nasdaq: BTCS) has significantly bolstered its Ethereum reserves, adding 14,240 ETH to bring its total holdings to 70,028 coins. At current prices of $3,850 per ETH, the company's stash is now valued at approximately $270 million.

The expansion follows a $207 million capital raise in 2025 through its innovative DeFi/TradFi flywheel strategy. This hybrid approach merges decentralized and traditional finance to maximize ETH exposure while minimizing shareholder dilution.

Separately, BTCS completed a $10 million convertible note financing at a substantial premium to market price. The proceeds will fuel further development of blockchain infrastructure projects.

Ethereum Price Could Hit $4,000 as ETF Inflows Surge Past $1.8 Billion

Ethereum's price surged 10% in four days, reaching $3,888 amid record-breaking ETF inflows. Institutional demand is accelerating, with BlackRock, Fidelity, and Grayscale leading the charge.

Weekly inflows hit $1.846 billion, the second-highest on record. Single-day inflows peaked at $533.8 million on July 22, signaling growing confidence in ETH as a core institutional asset.

The $4,000 price target appears increasingly likely before July ends, fueled by relentless capital deployment into Ethereum ETFs.

Ethereum Nears $4,000 as Altcoin Rally Gains Momentum

Ethereum's price surge toward $4,000 has reignited bullish sentiment across crypto markets. The second-largest cryptocurrency by market cap rose 1.66% this week to $3,749.81, with traders anticipating a potential breakout that could catalyze broader altcoin gains.

Market capitalization stands at $452.72 billion, while daily trading volume cooled 37.2% to $29.04 billion—a healthy consolidation after recent upward momentum. Ethereum maintains its dominance as the premier smart contract platform, though Layer 2 solutions and cross-chain DeFi projects continue attracting capital.

The rally coincides with growing interest in utility tokens beyond meme coins, with investors increasingly targeting early-stage projects demonstrating real-world use cases. Remittix (RTX), a new payments token, has emerged as one such beneficiary of this trend.

ETH Price Predictions: 2025, 2030, 2035, 2040 Forecasts

| Year | Price Target (USD) | Catalysts |

|---|---|---|

| 2025 | $13,000 | ETF inflows, institutional demand |

| 2030 | $25,000 | Mass DeFi adoption, scalability solutions |

| 2035 | $50,000 | Global reserve asset status |

| 2040 | $100,000+ | Full tokenization of assets |

BTCC's Mia projects ETH could reach $13K by late 2025, driven by ETF adoption and institutional reserves. Long-term, scaling solutions and DeFi growth may propel ETH to $100K+ by 2040.